Well Up: GLP-1 and Hormonal Health, Gamified Ecommerce and Creatine’s Resurgence

This week in health, beauty, ecommerce and beyond:

In this edition, we explore how Hims & Hers’ streamlined access to GLP-1s is unlocking broader hormonal health conversations, and how brands like e.l.f. and Walmart are merging gaming with mental wellness to reach Gen Z in new ways. Plus, creatine is having a major moment, with new consumers and use cases driving nearly 50% YoY growth. We also touch on other buzzy headlines—from designer sex toys to smarter supplement shopping and the growing allure of beauty dupes.

Can Streamlined GLP-1 Access Influence Other Treatments?

On March 7, Hims & Hers announced the sudden closure of Apostrophe, a teledermatology service Hims & Hers had acquired in 2021. Experts believe the shift signals a doubling-down on weight loss.

Beauty Independent highlighted that “as it pivoted to weight loss last year, Hims & Hers’ share price soared 172% and reached an all-time high of nearly $73 in February this year.”

In January, Hims & Hers also published a press release spotlighting its emphasis on GLP-1s interconnecting with another focus: menopause. Axios pointed to this synergy in its recent article entitled, “Online GLP-1 sales fuel hormone replacement therapy.”

Axios explains that as telemedicine companies increase access to weight-loss drugs, these all-in-one hubs are managing to connect more and more women with the “once-stigmatized treatment: hormone replacement therapy” (HRT). The piece points to a 2024 Mayo Clinic Study that found that HRT used “in tandem with GLP-1s like Ozempic and Wegovy were associated with about 30% more total body weight loss than GLP-1s alone,” and begs the question: What other health categories will see innovation spurred by GLP-1s?

Mental Health in the Metaverse

While Revolve’s fashion styling game, Bellemint, may seem like an unexpected move for the brand, studies show that Gen Z spends more time playing games than they do on social media.

The World Advertising Research Center reported that Gen Z consumers spend “a quarter (25%) of their leisure time playing video games,” compared to 18% of their leisure time on social media and 17% streaming video content. Similarly, Comscore’s 2024 State of Gaming Report found that 80% of Gen Z and millennials play mobile games, and 82% have made in-game purchases.

Given this, Bellemint, which allows users to sift through virtual versions of real-life products, seems primed to expand discoverability and expand the path to purchase.

e.l.f. Beauty and Walmart have explored similar initiatives on Roblox, but on March 11, they took it one step further: In partnership with the nonprofit Ad Council and Utah-based Huntsman Mental Health Institute, the companies launched Love, Your Mind World — “the first nonprofit experience on Roblox dedicated to improving teen mental health.” BeautyMatter explains that the experience offers “mental health education and coping strategies to support teens' emotional well-being” — and underscores that recent studies show that “40% of Roblox users (72% ages 13-17) feel more authentically themselves in the metaverse compared to the physical world, while 25% believe spending time on Roblox improves their mental health.”

e.l.f. Beauty's Gamer in Chief, Anna Bynum emphasized that “At e.l.f., kindness isn’t just a value; it’s in our DNA.” an idea that echoes similar messaging backing Ulta’s 2024 Joy Project.

These new initiatives point to gaming as a major lever for discovery among rising generations of shoppers. Brands that are able to engage meaningfully in this space could carve new inroads for brands in the future of ecommerce.

Creatine Sales Are Up — Way Up

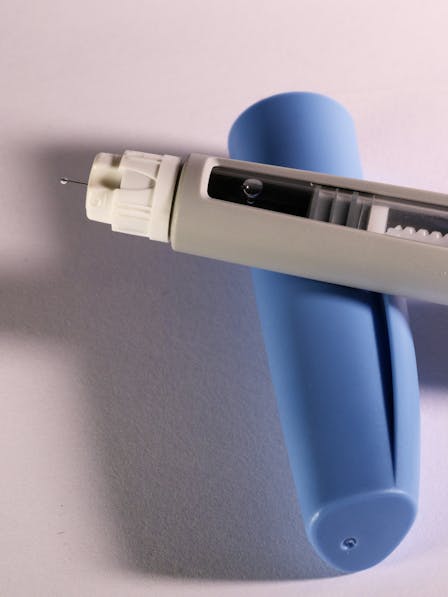

According to market research firm SPINS, U.S. creatine sales grew 49% YoY. Across the performance nutrition category, sales surged from $61.6 million to $91.7 million for the 12 months leading up to February 2025.

SPINS Senior Director of Market Insights, Scott Dicker, explains that creatine is finding broader appeal - the supplement has "expanded to women, it’s expanded to older generations, and they’re studying it for things like brain health.”

Experts at the 2025 Sports & Active Nutrition Summit explained that many new users are discovering the ingredient via TikTok. Others, like Abbie Smith-Ryan, PhD, of the University of North Carolina at Chapel Hill presented on the possibilities for women’s creatine supplementation “as it relates to cognition, lean body mass and the menstrual cycle.”

NutraIngredients emphasizes that a number of papers have been published in recent years on the possible benefits of creatine for “women, tactical athletes, older adults and even infants, across health focuses spanning cognition and memory, brain injury sleep deprivation, postmenopausal bone structure and immune support.”

As Creatine’s meteoric rise shows no signs of stopping, brands can prepare to capitalize on the ingredient’s fame, and start preparing now for synergistic launches.

Other noteworthy headlines:

According to Vogue, Emily Oberg Made a Sex Toy You’ll Post on Grid

The SuppCo App Is on a Mission to Streamline the Complicated Supplement Category

Beauty Independent Explains Why Beauty Investors Love Dupes

E.l.f. Cosmetics Just Became the National Women’s Soccer League’s First Sponsor